The VC&PE segment is essential for Brazil’s economic development. It is a type of private investment that involves participation in companies with high growth and profitability potential, through the acquisition of shares or other securities (convertible debentures, subscription bonuses, among others), with the aim of obtaining significant capital gains in the medium and long term.

While venture capital is related to early-stage ventures, private equity is linked to more mature companies, in the process of restructuring, consolidating and/or expanding their businesses. Through these investments, companies have access to smart capital to finance their growth, encouraging the professionalization of companies, with the creation of appropriate corporate governance structures, focusing on growth and profitability, as well as the future sustainability of the business.

The essence of the investment is to share the risks of the business, sealing a union of efforts between managers and investors to add value to the invested company. Investments can be directed to any sector that has the prospect of high growth and profitability in the long term, according to the investment focus defined by investors or funds.

Equity funds, vehicles used for most of these investments, provide essential capital for companies to follow their path through innovation and promote growth in the real economy, job creation and global competitiveness. These investments are the fuel for innovation and progress.

Value Investment in PE&VC

R$10B

Invested in PE

$50B

Invested in VC

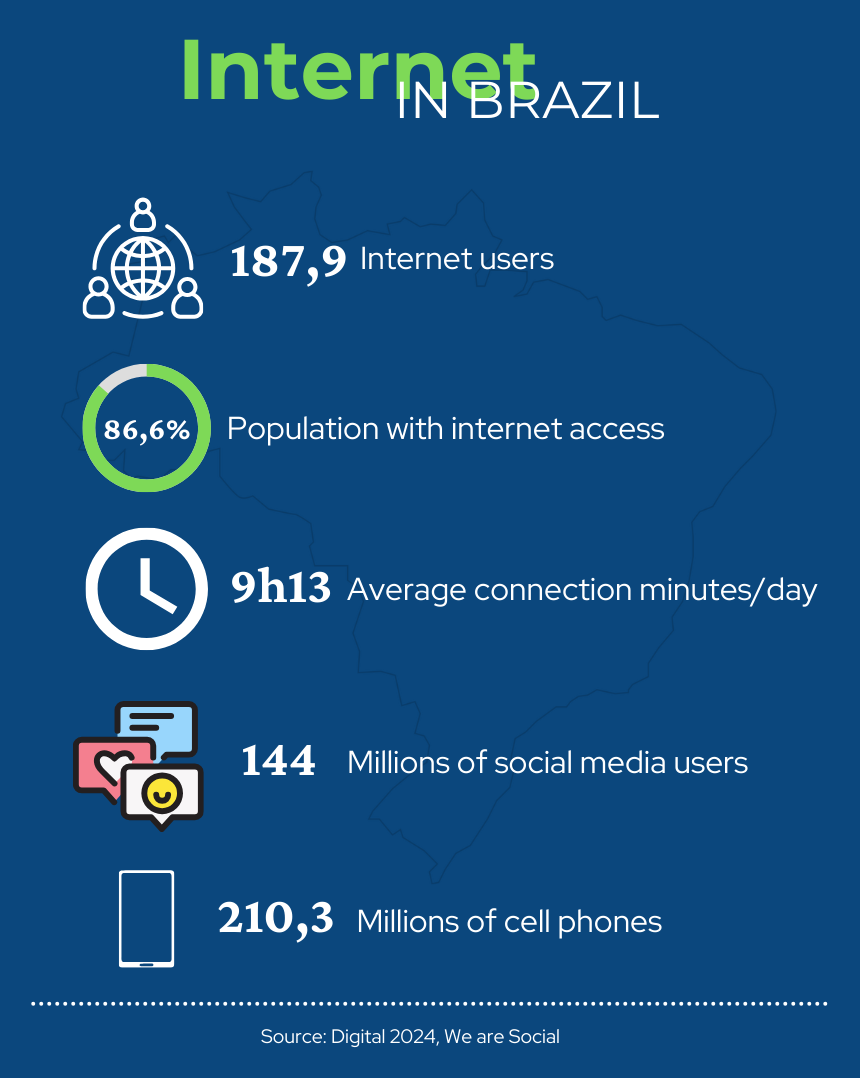

The Brazilian economy is diverse and thriving, with robust sectors such as agribusinesses, infrastructure, technology and renewable energy. In addition to its rich biodiversity, the country is undergoing an accelerated digital transformation process in the areas of work, education, entertainment, communication, banking services and many others.

As the largest economy in the region and among the top 10 economies worldwide, the country has a myriad of opportunities in technological sectors such as fintechs, healthtechs, edtechs, martechs, games, mobility, among others. It also leads the ranking of long-term investments in Latin America and it is no wonder that, of the 45 Latin American unicorns, more than half are Brazilian.

In addition, Brazil offers a safe and attractive environment for investments, which is combined with a mature ecosystem with sophisticated players in all segments of the chain. See the list of our associates here.

Our economic resilience and diversity create a promising scenario for investors from all over the world.

In terms of investment exits, the role of VC&PE as a fundamental instrument in the development of the Brazilian capital market is also highlighted. Around 40% of the companies that went public in the last 10 years on the Brazilian Stock Exchange had investments from PE&VC funds, which proves that high-level governance and the professional work of adding value by PE&VC funds is a differentiator in the growth and sustainability trajectory of companies.