Our Governance

Learn about ABVCAP's governance structure, principles, boards, committees, and the Bylaws that guide its institutional activities.

Statute and General Assembly

The General Assembly is the Association’s highest governing body.

The General Assembly, composed of the community of members, has the following responsibilities: to deliberate on the representativeness and scope of the Association; to define the rules for membership and dismissal of members; to elect, approve or dismiss members of the Deliberative and Fiscal Councils; to decide on the application of penalties to members; to approve the Association's accounts annually; and to deliberate on the entity's future.

Deliberative Council

The Deliberative Council is the permanent operating body responsible for the strategic direction of ABVCAP, composed of twelve members, associates of ABVCAP, for a term of 3 (three) years.

At least six members must be representatives of Managing Associates and a maximum of six may be representatives of other ABVCAP membership categories.

The Deliberative Council has nine members elected by the General Assembly and three members appointed by the majority of the members of the Deliberative Council, with the support of the Nomination Committee.

Advisory Board

The Advisory Board is a non-permanent advisory and consultative body of ABVCAP, established by the Deliberative Council, focused on providing strategic support and advice. It may include up to 12 invited external members with notable capital markets expertise, appointed by the Deliberative Council for three-year terms.

Former presidents of the Deliberative Council also form part of the Advisory Council as lifetime members, provided they do not hold other governance positions at ABVCAP.

Its members can propose measures of interest to the association, suggest projects, programs, and methodologies, and provide opinions on topics submitted by the Deliberative Council, contributing to the organization's guidelines and strategic planning. Their opinions and proposals, however, are not binding.

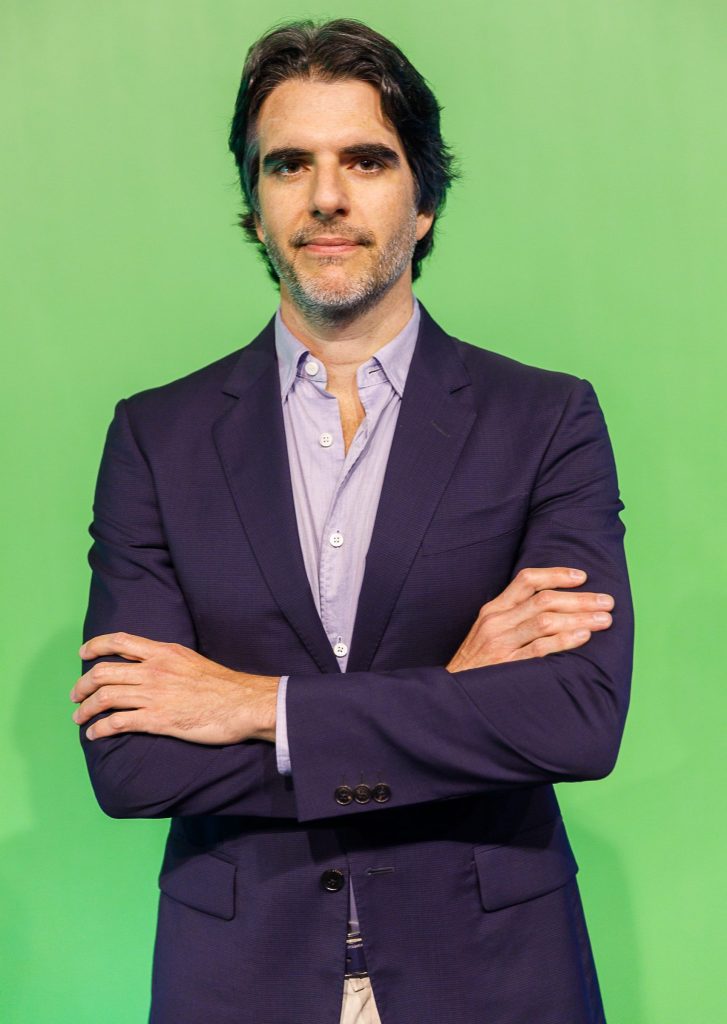

Alvaro Gonçalves

Stratus Group, former President of ABVCAP

Clovis Benoni Meurer

CRP – Holding Company, former President of ABVCAP

Flavia Mouta Fernandes

B3

Maria Cecilia Rossi

InterLink Consulting

Martin Miralles Pose

TozziniFreire Lawyers

Marcus Regueira

Mayo Clinic, former President of ABVCAP

Patricia Freitas

ABVCAP Member

Roberto Hesketh

Multicapital of Brazil, former President of ABVCAP

Sidney Chameh

DGF Investimentos, former President of ABVCAP

Maria Susana Garcia-Robles

Capria Ventures

Committees

The Sustainability Committee's objective is to produce knowledge on the topic for stakeholders, aiming to permeate the entire investment cycle of managers and investors; self-regulation; broadening the debate and building an agenda in partnership with other financial market institutions, in addition to increasing the scope and relevance of the Sustainable Investment Forum (FIS), as a center for these debates and promoting a deep and strategic reflection on the role of the alternative assets industry in global economic and social development.

Sponsor: Maria Cristina Penteado, Blue Orange Sustainable Capital

Lead Coordinator: Filipe Borsato, BNDES

The purpose of the Regulatory Committee is to monitor regulatory and legislative changes that may impact the alternative investment industry in Brazil and its stakeholders, proposing improvements deemed necessary in line with best practices and, whenever possible, following international benchmarks. This committee works alongside all of the Association's sectoral committees to analyze proposed standard revisions. Together with the Deliberative Council, the CER serves as an intermediary between ABVCAP and public and regulatory agencies for industry requests.

Sponsor: Marina Procknor, Mattos Filho Lawyers, Vice-President ABVCAP

Lead Coordinator: Luiz Eugenio Figueiredo, BRAM, Vice-President ABVCAP

The objective of the Events and Educational Committee is to map the main training demands of stakeholders in the alternative assets ecosystem, as well as to organize training, workshops, events and missions capable of enhancing networking opportunities and relationships between ABVCAP members and non-members and promoting the improvement of those who work or want to work in the alternative assets industry, in general, sharing the best operational practices, through reference cases of this industry.

Sponsor: Danilo Soares, Treecorp Investments, ABVCAP Advisor

The Private Equity Committee brings together managers to discuss issues related to investment operations in already established companies with great potential for growth and consolidation, and to propose regulatory changes that favor the development of these activities in Brazil, as well as attract local and global capital to these companies, in addition to offering exit opportunities and legal security to investors, capable of increasing the attractiveness of these investments.

Sponsor: Fernando César Dantas Borges, SPX Capital, ABVCAP Advisor

The Venture Capital Committee brings together managers to discuss VC investments, innovation, and entrepreneurship, and to propose regulatory changes that will favor the development of their activities in Brazil and unlock investments in early-stage companies.

Sponsor: Pedro Melzer, Igah Ventures/Pátria Investimentos, ABVCAP Advisor

Lead Coordinator: Marcello Gonçalves, Domo Investments

The Committee's objectives are to promote best practices for CVCs aligned with international industry standards, share experiences on the various operating strategies of this segment, promote improvements in the legal and regulatory framework for R&D&I investments by corporations, foster networking opportunities and build relationships among committee members, and conduct studies and research to monitor the evolution of CVCs in the country and serve as a global reference.

Sponsor: Joaquim Lima, Riverwood, ABVCAP Advisor

Lead Coordinator: Gustavo Cavenaghi, Kortex Ventures

The objective of the Institutional Investors Committee is to expand the participation of Brazilian institutional investors – pension entities, family offices, insurance companies, endowments, development and development banks, among others – through ABVCAP and its associates, in Brazilian private asset classes, providing legal certainty and a legal framework appropriate to the attractiveness of these investors.

Sponsor: Rafael Bassani, Spectra Investments, ABVCAP Advisor

Lead Coordinator: Alexandre Cunha, Nebraska

The objective of the Non-Resident Investors Committee is to encourage investment by international investors through ABVCAP and its members in Brazilian private asset classes – private equity, venture capital, infrastructure and special situations, providing legal certainty and a legal framework suitable for attracting foreign capital.

Sponsor: Jorge Lange, ABVCAP Advisor

Lead Coordinator: Carlos Moreno, IFC

Our team

Executive Superintendent

Executive Manager

Assistant to the Board

IT Coordinator

Financial Coordinator

IT Analyst

International Analyst

Financial Analyst

Financial Administrative Assistant

International Project Consultant