Investing in Brazil

Our economic resilience and diversity create a promising landscape for investors around the world.

Current panorama

The Venture Capital (VC) and Private Equity (PE) sector is a strategic driver of Brazil's economic development. By injecting smart capital into companies with high growth potential, these investments drive innovation, professionalize management, and strengthen corporate governance.

Despite its youth, Brazil's alternatives market is one of the most sophisticated globally. Part of this success is the dialogue and engagement between the private sector and regulatory bodies and government agencies. Throughout the industry's history, several regulatory frameworks have had a direct impact on market expansion and improved business environments, taking into account the increase in local and foreign investors, as well as the sustainable growth of Brazilian companies.

- Both models share the risk with entrepreneurs, with the aim of adding value and generating significant returns in the medium and long term.

R$128 Billion

R$116 Billion

Brazilian market highlights

• Regional leadership in VC&PE investments.

• Mature ecosystem, with experienced investors, managers and companies.

• Accelerated innovation environments in areas such as fintechs, healthtechs, edtechs, games and mobility.

Industry History

2003

2007

2008

2016

2017

2017

2018

2021

2022

2022

2023

2023

2024

Impact

+R$245 Billion

+2777

Brazil is the largest economy in Latin America and among the ten largest in the world. With strong sectors such as agribusiness, renewable energy, and technology, the country is undergoing an accelerated digital transformation and stands out in fintech, healthtech, edtech, gaming, and mobility.

This innovative environment has already made Brazil home to more than half of the region's unicorns and one of the most attractive destinations for long-term investments.

Venture Capital and Private Equity funds play a central role in this story: they support companies that are now part of our daily lives, drive innovation, and strengthen the capital markets. Proof of this is that approximately 40% of the companies that went public in the last decade relied on their investments.

With its resilience, diversity, and ability to generate value, Brazil is fertile ground for investors seeking sustainable growth and global opportunities.

Private Equity

Private Equity (PE) funds are essential for innovative companies with growth potential. They have diversified their investments, with a significant increase in the Information Technology and Financial Services sectors, which traditionally receive venture capital seeking high returns.

Furthermore, entry into emerging sectors such as digital health and green technologies is a clear demonstration of the impact of Private Equity funds on the development and modernization of markets.

- PE funds also play a key role in companies' IPOs in Brazil. These funds provide resources and expertise for company growth, preparing them for IPOs (Initial Public Offerings). This strengthens corporate governance and expands access to the capital markets, generating greater liquidity and expansion opportunities.

2020

2021

Venture Capital

Venture Capital (VC) funds are essential for developing sectors with high-growth and innovation potential. In this modality, managers and investors focus on startups that promote innovation and transformation, focusing on impactful technological solutions across a variety of sectors, especially those with opportunities for global scalability.

Although Brazil still has fewer unicorns compared to other countries, such as the US and China, it holds a leading position in Latin America. This success has been strongly driven by the active participation of VC funds, which provide capital and strategic support for the accelerated growth of these startups, leading many of them to unicorn status.

- Brazilian unicorns (startups with valuations above US$1 billion) have stood out in the innovation environment, boosting the country's technology ecosystem by developing disruptive solutions and attracting international investment.

Brazilian Unicorn Startups

99

Brazil's first unicorn startup, 99, is an urban mobility app that competes with other giants in the ride-hailing sector. In 2018, it was acquired by the Chinese company Didi Chuxing, marking the first full acquisition of a Brazilian startup by a foreign company.

C6 Bank

Digital bank offering accounts with no maintenance fees, investments, credit, and international accounts. It became a unicorn due to its rapid expansion and innovation in financial services. It received a significant investment from JPMorgan Chase in 2021, boosting its growth in the digital banking market.

CloudWalk

Payment platform that includes the InfinitePay card reader, focusing on low-cost transactions for small merchants. It received significant investments from Coatue and Valor Capital Group in 2021, solidifying its position among the most promising fintechs in the payments sector.

Credits

Fintech focused on secured personal loans, offering competitive interest rates and real estate and automotive financing solutions. It received funding from funds such as SoftBank and VEF, enabling the expansion of its credit lines and financial products.

Dock

A platform that enables the creation of customized financial solutions for companies, such as card issuance and payment processing. It has received investments from funds such as Lightrock and Silver Lake, and Visa is one of its main shareholders.

Ebanx

Offers international payment solutions, facilitating transactions between Latin American consumers and global e-commerce companies. In 2021, it received a significant investment from Advent International to expand its operations in Latin America.

Easily

Social e-commerce app that encourages group buying to offer lower prices. It raised significant funding in 2021, achieving unicorn status with investments from Goodwater Capital and Rise Capital.

Frete.com

A logistics startup that connects truck drivers and companies to optimize transportation and reduce downtime. With funding from investors like SoftBank, it expanded its network of carriers and expanded its operations.

Gympass (Wellhub)

Corporate wellness platform that offers access to gyms and physical activities. It received investments from SoftBank and General Atlantic, enabling its global expansion with partnerships in several countries.

Hotmart

Focused on digital education, Hotmart allows the creation, hosting, and sale of online courses and content. With investments from TCV and GIC in 2021, it strengthened its global presence in digital education.

iFood

A pioneer in food delivery in Brazil, iFood uses technology to optimize deliveries. With majority investment from Prosus and Movile, it expanded its innovations to include drone deliveries and artificial intelligence.

Loft

A platform that streamlines the buying and selling of properties using technology. It received investments from Andreessen Horowitz and SoftBank, expanding with the acquisition of CrediHome to strengthen its real estate financing operations.

Loggi

Offers logistics and delivery services to companies, connecting customers and delivery drivers throughout Brazil. With investments from SoftBank and Monashees, it expanded its logistics infrastructure and expanded its operations.

WoodWood

Furniture and decor marketplace that operates both as a direct seller and as a platform for retailers. It received investments from SoftBank and Dynamo, strengthening its marketplace and integrating new product categories.

Merama

A company that accelerates digital brands in Brazil and Latin America, providing capital and expertise for expansion. Founded with support from funds such as Valor Capital and SoftBank, it invests in acquisitions to leverage regional e-commerce.

Bitcoin Market

The largest cryptocurrency exchange in Latin America, facilitating digital asset transactions. In 2021, it received a significant investment from SoftBank, enabling the expansion of its operations.

Neon

Digital bank offering accounts, investments, and credit cards as an affordable alternative. It became a unicorn after investment rounds led by General Atlantic, expanding its service offering.

Nubank

Brazil's leading digital bank, it offers a digital account and credit card with no annual fee. In 2021, it went public on the New York Stock Exchange (NYSE) and received investment from Berkshire Hathaway, consolidating its global presence.

Olist

A platform that helps companies sell online, integrating stores with marketplaces and offering e-commerce management. With funding from SoftBank and Goldman Sachs, it expanded and acquired other platforms to grow in the sector.

Pismo

Provides infrastructure for financial services, enabling banks and fintechs to implement payment and credit solutions. It received investment from Amazon and SoftBank, expanding its operations into international markets, and was acquired by Visa in 2023.

Fifth Floor

A platform that facilitates property rentals and purchases, eliminating the need for guarantors through advanced credit analysis. With funding from SoftBank, it expanded its operations and entered new markets, in addition to selling real estate.

Single

Specialist in facial biometrics and secure digital authentication solutions. Investments from SoftBank and General Atlantic have enabled the development of new digital security solutions.

VTEX

E-commerce platform for creating online stores, integrating with marketplaces, and managing orders. It went public on the NYSE in 2021, raising funds for global expansion.

Wildlife Studios

Mobile game developer with international reach. Investments from Benchmark and Bessemer Venture Partners enabled its expansion and development of games for a global audience.

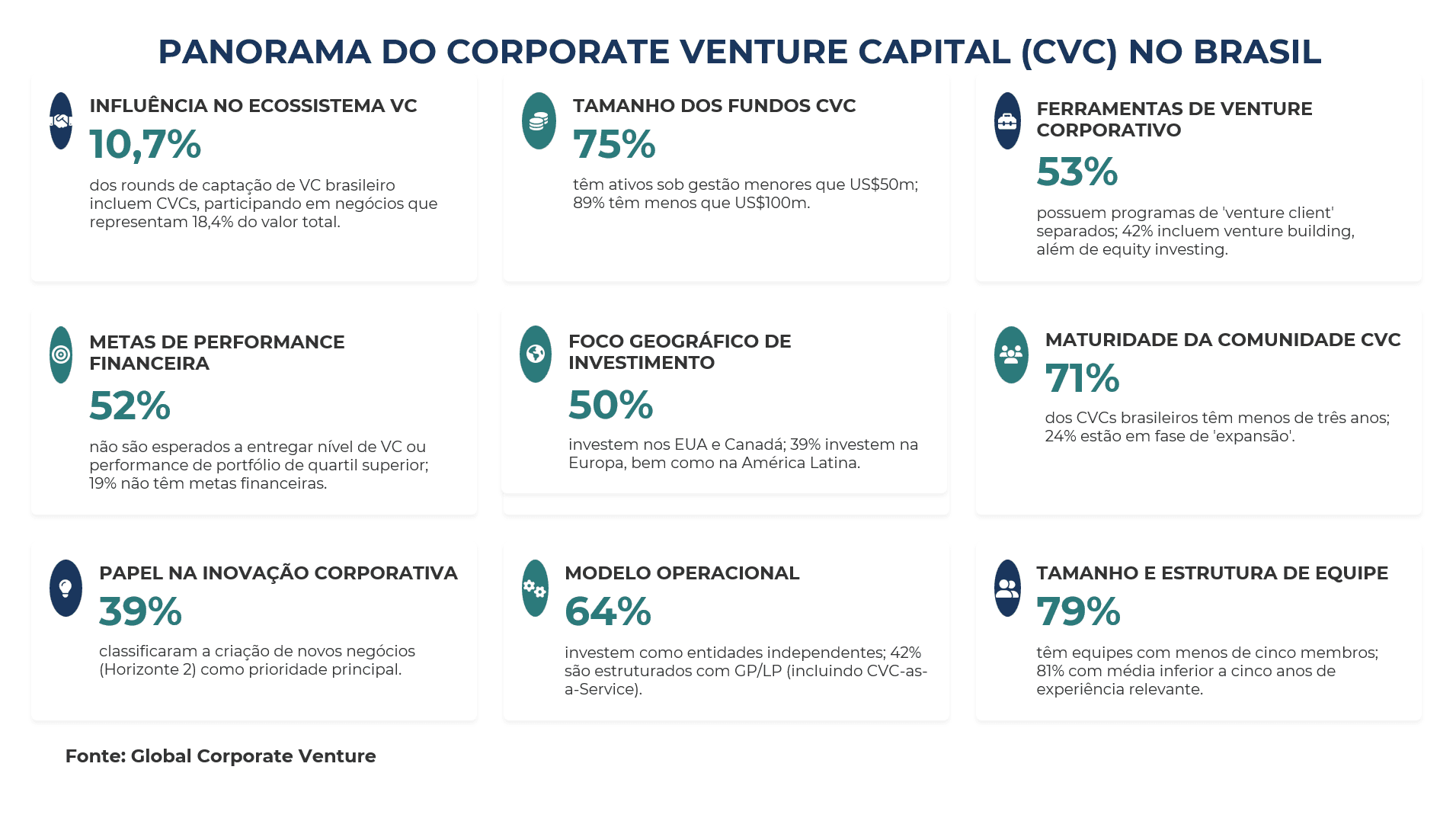

Corporate Venture Capital

Corporate Venture Capital (CVC) is a relevant investment and open innovation instrument, in which corporations invest in startups. This model has gained momentum in recent years and, in addition to driving innovation and new strategic businesses in a competitive global environment, also aims to generate financial returns for investing companies, similar to traditional venture capital.

In 2020, ABVCAP created the Corporate Venture Capital Committee to accelerate the development of this model within corporations and the Brazilian innovation ecosystem. The committee seeks to disseminate national and international best practices, in addition to representing the sector before regulators and the government, with the goal of improving legislation and strengthening the investment environment. In 2023, ABVCAP, through the CVC and Regulatory Committees, presented to the CVM proposals to improve Resolution No. 175, which regulates Investment Funds.

- According to research by ABVCAP, the top priority of Corporate Venture Capital (CVC) programs is generating new business, with a growing focus on financial returns and supporting existing operations. This indicates a strategic evolution toward more concrete and immediate results.

Cases

AGV Logística, one of Brazil's largest 3PL logistics service providers, underwent a major transformation with Kinea's investment. Operating under an asset-light model, the company implemented segmented governance, divided its operations into two business units – AGV Health & Nutrition and FMCG – and made significant investments in technology. These efforts resulted in an 80% increase in EBITDA, an 8.4 percentage point expansion in margin, and a 7.8x increase in net income, culminating in the distribution of R$$92 million in dividends during the investment period. Currently, AGV maintains its operations focused on integrated logistics and continues to expand its presence in strategic markets in Brazil.

App Prova, an educational testing platform designed to improve student performance on important exams, also excelled with the support of e.Bricks Ventures. The company's recurring revenue grew from R$1,400,000 to R$1,400,000 in two years, and its team expanded from 8 to 50 employees. The success culminated in the acquisition by SOMOS Educação, which integrated the platform into its education system.

BR Supply, a specialist in corporate supply management, achieved impressive results with CRP's support. Between 2010 and 2016, its revenue grew by 5,001 TP3T and EBITDA increased by 7,011 TP3T. The implementation of boards of directors and governance improvements ensured greater scalability and solidity for the business, which became a benchmark in the segment. Currently, the company continues to consolidate its leadership in the supply management segment, serving large corporations.

Burger King Brazil was transformed by Vinci Partners from a greenfield project with just over 100 stores to an operation with over 800 units in 2019. The aggressive expansion plan, which included robust governance and efficient processes, resulted in net revenue of R$1.5 billion in 2018, with average annual growth of R$4.51 billion since 2012, and EBITDA of R$1.4 billion in 2018. In December 2017, the company went public on the B3 stock exchange, consolidating its position as a leading player in the foodservice sector.

Celesc, a state-owned energy company in Santa Catarina, was supported by Angra Partners in its journey to improve governance and operational efficiency. During the investment period, ROIC increased from 5% to 12% per year, and the DEC indicator, which measures power outages, fell from 14.7 hours to 10.7 hours. The divestment was completed with the sale of the stake to EDP Brasil. The Santa Catarina state-owned company remains one of Brazil's leading electricity distributors and remains listed on the B3 stock exchange, playing a key role in the electricity sector. Currently, Celesc remains focused on modernizing its infrastructure and improving services for consumers.

Forno de Minas, a pioneer in frozen cheese bread, diversified its portfolio to include croissants, waffles, and stuffed pastries with the support of Crescera. Between 2010 and 2017, revenue grew from R$1,400,000 to R$1,400,000,000, with an EBITDA of R$1,400,000 in 2017. The case ended with the sale of the company to McCain, consolidating its position in the frozen food market. Under the new management, Forno de Minas further expanded its presence in the international market.

Grupo São Francisco, one of Brazil's largest healthcare groups, was supported by Gávea Investimentos in its expansion and governance improvements. Over the course of three years, revenue more than doubled, the number of owned hospitals quadrupled, and the EBITDA margin grew 40%. The period included 11 strategic acquisitions. In 2019, the Group was acquired by Hapvida, one of Brazil's largest health plan providers. Its units and services continue to operate under the new management, with operational expansion and structural improvements.

Mãe Terra, an organic food producer, professionalized with the support of BR Opportunities, now X8 Investimentos, expanding its distribution channels and introducing higher-value products such as cereal bars and granola bars. The company recorded annual revenue growth of 35% and was sold to Unilever, consolidating its expansion into the healthy products market.

Mosyle, an EdTech startup, grew significantly with DGF's investment. The company internationalized its operations and focused on the mobile device management (MDM) market. Between 2015 and 2018, its revenue grew from R$1.5 billion to R$1.74 billion, with EBITDA growing from negative to R$1.5 billion. This success was driven by its focus on the education market and global expansion. Currently, the company continues to grow in the North American market, solidifying its position as a leader in educational technology.

Total Voice, a leader in VoIP telephony, was acquired by Zenvia to expand services such as API calls and automated voice messages. With the support of Bossa Nova, the company reached over 1,000 customers in 2018, recording average monthly growth of 7,17% and a gross margin of 49,13% before the divestment. The company was integrated into Zenvia following its acquisition, and Total Voice's communication solutions remain part of Zenvia's portfolio.

Yller Biomateriais, a manufacturer of dental materials, expanded its production and market with the support of Crescera. Its products are now sold through more than 400 distributors in Brazil, with exports to more than 20 countries. Revenue grew by 300% in 2017 and 26.5% in 2018, reaching R$$4.5 million, consolidating its presence in the dental segment. Yller continues to operate and expand its presence in the dental market, exporting products to more than 20 countries.

Our programs

Learn about ABVCAP's programs, which focus on internationalizing Brazilian private capital, promoting diversity in the alternative investment industry, and generating opportunities for young talent. Initiatives like inBrazil and Contrate um Jovem strengthen the ecosystem with social impact and a long-term vision.